Blog - Latest News

Advisers’ benefit goes beyond financial returns

Is financial advice worth the cost? The answer is a resounding “yes” as research shows that the value of Advisers’ benefits goes beyond financial returns.

Posted on November 6th, 2020

Estate Planning Essentials: Who Needs a Will?

“I can’t stress enough the importance of preparing a well-constructed Estate Plan” – wise words from Andrew Morris, Business Advice Manager at Soundbridge. Read on to find out why your Estate Plan is so important.

Posted on October 28th, 2020

Spotting signs of trouble in a retirement portfolio

“Retirement planning can be complex, and sometimes even the most obvious risks to a portfolio are more common than you may think,” says Barry Lucas, Financial Adviser at Soundbridge’s Mackay branch. “In these challenging financial times, it’s worth taking a closer look at your portfolio to make sure everything is on track.”

Posted on October 1st, 2020

Meet the Team: Richard Newton

Meet our Financial Adviser and Aged Care Specialist, Richard Newton, who works out of our Rockhampton Office. Listen to Richard’s insights into financial planning in an interview with Penny Farrell, General Manager of Soundbridge. Richard is an Electrician by trade,… Read more »

Posted on September 17th, 2020

Why you need a Will

It’s now more important than ever to have an estate plan so you can make sure your family and loved ones are looked after should you become ill or die.

Your estate plan is a set of arrangements that sets out what will happen to your assets when you die and/or if you become unable to manage your own affairs. Your Will is just one part of your estate plan.

Posted on September 10th, 2020

Meet the Team:Craig Cavanagh

Meet our Gladstone-based Financial Adviser, Craig Cavanagh. Craig shares his perspectives on financial planning in an interview with Penny Farrell, General Manager of Soundbridge.

Posted on August 28th, 2020

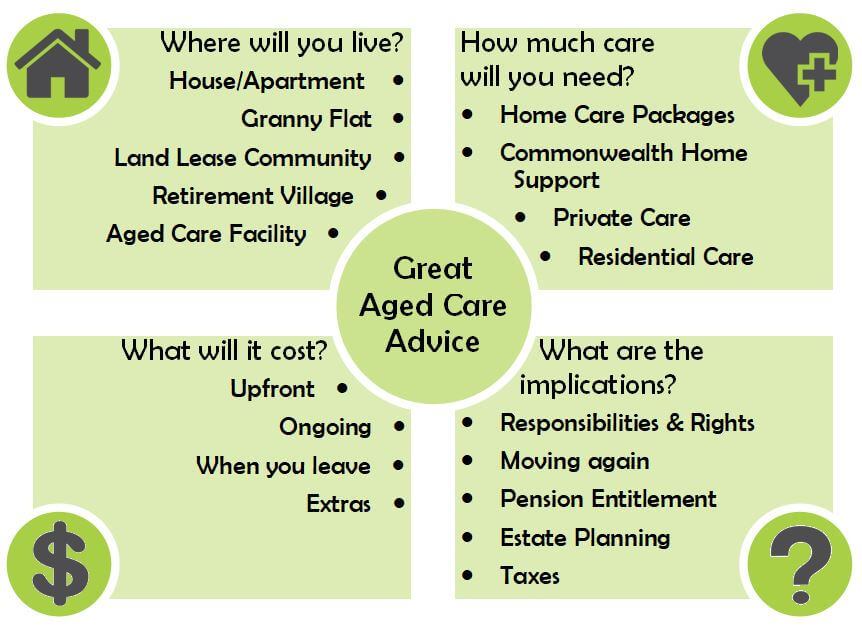

Aged Care Case Study with Richard Newton

Our Financial Adviser, Richard Newton, who is an Aged Care planning specialist, shares a case study for Seniors’ Week. “I had a family come in to the office, confused about the the aged care sector. Their father was ill, and… Read more »

Posted on August 21st, 2020

Aged Care Planning Insights

Moving into residential aged care may not be on anyone’s bucket list, but as the population ages, it’s a possibility that few of us can ignore. The average Australian can expect to live into their 80’s, and many of us will live beyond 90. That means more of us will need some form of aged care late in life. And as pressure grows on aged care service providers to cater for more people, the costs may rise.

Posted on August 13th, 2020

5 Financial things you should know by the time you’re 35

The actions you take now to set yourself up for the future, will take the pressure off down the track. So how do you go about gaining financial knowledge?

Posted on August 7th, 2020

Making the most of your Redundancy Payout

Facing redundancy can cause severe psychological distress, and have far-reaching financial implications. The good news is that your redundancy payment comes with financial opportunities.

Posted on July 10th, 2020

Lifestyle Inflation – Could it be your biggest financial threat?

“There’s a new villain in town, and it’s attacking the lower, middle and upper classes. It’s called lifestyle inflation, and it doesn’t care how much money you make—it can still find you.” David Ramsey As we embark on a new… Read more »

Posted on July 3rd, 2020

Want to be better with money?

Here are 10 tips from our experienced team for developing good money habits and a positive money mindset

Posted on June 26th, 2020